Articles

1031 Exchange Introduction

Utilized properly, 1031 exchanges provide investors with substantial tax savings that allow them to shelter the growth of their wealth. Read More

Introduction to Investment Grade Long-Term Net-Leased Property

Learn about the benefits and drawbacks of investment grade, long-term triple-net-leased (NNN) double-net-leased (NN) real estate. This article was originally written during one of the most tumultuous and difficult economic times throughout our... Read More

1031 Exchange: The Ultimate Guide [Infographic]

Learn how to defer your capital gains taxes, which properties qualify for exchange, what the rules and time limits are, and how to step up your basis. Read More

Delaware Statutory Trust and Other Real Estate Investment Structures

Read this simple guide to real estate ownership structures: sole ownership, Tenant-in-Common (TIC), Delaware Statutory Trust (DST), Real Estate Investment Trust (REIT), and real estate funds (LLC and LP). Read More

1031 Exchange Property Identification Rules

To defer capital gains taxes with a 1031 exchange, an investor must identify potential replacement properties, in writing, by midnight of the 45th calendar day after the close of escrow on... Read More

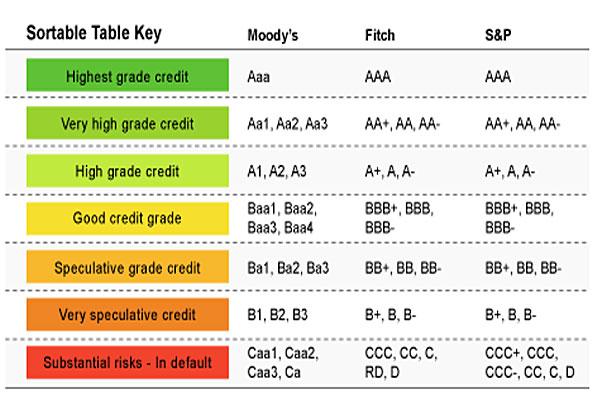

Corporate Credit Ratings

Corporate credit ratings are issued by rating agencies in order to provide investors with better insight into how well a particular organization is operating and able to pay off its liabilities and financial obligations. The three largest rating... Read More

1031 Exchange DOs and DON`Ts

1031 Exchange DOs and DON'Ts: 7 things you should do and 6 things you should not. Read More

Analyzing Lease Terms: What to Look for in a Double-Net or Triple-Net Lease

In addition to securing the right type of tenant, a sufficient lease term and the right lease structure, the terms of your lease protect your rights and the value of your asset over the long run. The lease terms described in this section are not... Read More

1033 Exchange / Eminent Domain Reinvestment

In the event of a natural disaster or eminent domain, the 1033 exchange can be utilized to defer capital gains taxes on the relinquished/lost property. Read More

721 Exchange UPREIT Introduction

The 721 Exchange, or UPREIT, allows an investor to exchange ownership in a single asset with units in an operating partnership with multiple assets. Read More

1031 Exchange Qualified Intermediary

To avoiding taking constructive receipt of the proceeds during a 1031 exchange, it is imperative that an investor have a Qualified Intermediary ("QI") hold the capital after the sale of the relinquished property. Read More