News

Watch: ExchangeRight’s Net-Leased All-Cash 2 DST Fully-Subscribed by Increased Demand for Its Debt-Free Offerings

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce that the company has fully subscribed its Net-Leased All-Cash 2 DST, a $24.84 million offering of net-leased... Read More

Watch: ExchangeRight Now Serving Over 8,000 Investors

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is honored to now be serving more than 8,000 investors who trust the company to steward their wealth with investments that have... Read More

Watch: ExchangeRight’s Resilient Performance in 2023

ExchangeRight, one of the nation’s leading providers of diversified real estate REIT and DST investments, has announced that despite the ongoing challenges facing the commercial real estate market, all ExchangeRight’s offerings continued to... Read More

Join Us at The Blue Vault Bowman Alts Summit

Join ExchangeRight’s Managing Partner Joshua Ungerecht and the company’s Strategic Relations team at The Blue Vault Bowman Alts Summit March 11–13 at The Omni PGA Resort in... Read More

The Essential Income REIT Achieves 9.91%–10.54% Tax-Equivalent Yields on 2023 Distributions

ExchangeRight, one of the nation’s leading providers of diversified real estate REIT and DST investments, has announced that the Essential Income REIT’s tax-equivalent yield on 2023 distributions was 9.91% for its Class A shares and 10.54% for... Read More

Art Miller Joins ExchangeRight’s Growing Strategic Relations Team

ExchangeRight, one of the nation’s leading providers and asset managers of investment real estate, has announced the appointment of Art Miller to its Strategic Relations team as senior vice president of the Northeast region to help meet growing... Read More

ExchangeRight Adds SVP Michael Leydig to Strategic Relations Team

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that to meet the growing demand from representatives and advisors across the country to utilize ExchangeRight’s historically... Read More

ExchangeRight Ends 2023 as Third Largest Sponsor in the DST Market

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that thanks to trust placed in the company by broker-dealers, RIAs, and their clients across the nation, ExchangeRight ended... Read More

ExchangeRight Fully Subscribes a $125.8 Million Diversified Portfolio

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the company has fully subscribed Net-Leased Portfolio 63 DST, a $125,802,000 offering featuring 510,625 square feet of... Read More

How to Use Asset Allocation in Real Estate Advising

DI Wire is featuring a new think piece from Managing Partner Joshua Ungerecht, titled “How to Use Asset Allocation in Real Estate Advising.” In the article, he shares that representatives and advisors have an exceptional opportunity to... Read More

ExchangeRight’s Essential Income REIT Now Tracked by Blue Vault

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the company’s Essential Income REIT is now being tracked and reported on by Blue Vault... Read More

ExchangeRight Expands Strategic Relations Team with Kara Howard, Director of National Accounts

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the company has expanded its Strategic Relations team with the addition of Kara Howard as director of national accounts... Read More

ExchangeRight’s Geoff Flahardy Promoted to President of Strategic Relations

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that Geoff Flahardy has been promoted to ExchangeRight’s president of strategic relations... Read More

ExchangeRight Investors Fully Subscribe All-Cash Essential Grocery DST

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced investors have fully subscribed ExchangeRight’s Essential Grocery DST, a $29.2 million all-cash offering featuring a... Read More

ExchangeRight Fully Subscribes a $90.5 Million DST Created for Recession-Resilience

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the company has fully subscribed its Net-Leased Portfolio 60 DST, a $90,500,000 offering featuring 397,201 square feet of... Read More

Join Our Team in Las Vegas at ADISA's Annual Conference

Join our Broker-Dealer and RIA Relations team during ADISA’s 2023 Annual Conference and Trade Show October 9–11 at The Cosmopolitan... Read More

ExchangeRight Attends Its First Future Proof Festival

Members of our Broker-Dealer and RIA Relations team are happy to have had the opportunity to engage with Wealth Advisors during ExchangeRight’s first time attending Future Proof Festival... Read More

ExchangeRight’s Essential Income REIT Acquires $84 Million Portfolio

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the company’s Essential Income REIT has acquired a portfolio of 15 net-leased assets, adding 231,654 square feet of... Read More

ExchangeRight Achieves 133.18% to 142.47% Total Returns Including Return of Capital with 33rd Full-Cycle Offering

PASADENA, Calif. - ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the company has successfully brought its 33rd offering full cycle on behalf of investors... Read More

ExchangeRight’s $110 Million Offering Designed for Recession-Resilience Achieves Full Subscription

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the company has fully subscribed its Net-Leased Portfolio 62 DST, a $110.12 million offering totaling 428,605 square feet net Read More

ExchangeRight Fully Subscribes a $109 Million Offering Designed for Economic Resilience

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the company fully subscribed its Net-Leased Portfolio 61 DST, a $109.37 million offering totaling 377,666 square feet... Read More

ExchangeRight Announces Collection of 100% of Rent Due Across Entire Net Lease AUM Inception-to-Date

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the company has maintained its track record of collecting 100% of rent due from its net-leased assets under management... Read More

ExchangeRight Increases Market Share in First Half of 2023

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that it has increased its share of the 1031 DST market in the first half of 2023 compared to the 2022 year, representing... Read More

ExchangeRight REIT Completes 506(c) Conversion Following Successful Public Reporting Launch

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that the ExchangeRight Essential Income REIT has converted to a 506(c) offering... Read More

ExchangeRight’s Essential Income REIT Successfully Becomes Publicly Reporting Company

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the ExchangeRight Essential Income REIT has become a publicly reporting company as of June 26, 2023, expanding the REIT’s... Read More

ExchangeRight Successfully Completes 32nd Full-Cycle Event, with Annualized Returns Ranging 8.25%–9.75%

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the successful completion of its Net-Leased Preferred Equity Fund 3 (“NLPEF 3”), a fund that consistently generated 8.25%–9.75%... Read More

ExchangeRight Income Fund Files Form 10 To Become SEC Reporting Company

ExchangeRight Income Fund, d/b/a ExchangeRight Essential Income REIT (the "Company"), a self-administered real estate company invested in a diversified portfolio of properties with long-term net leases backed primarily by investment-grade tenants... Read More

Join ExchangeRight at IPASummit 2023 Capitol Hill Day and Due Diligence Symposium

Connect with ExchangeRight's David Fisher, Managing Partner and IPA Outstanding Service Award winner, and Beth Veloz, Senior Vice President and IPA Rising Leaders Council member at IPA’s Capitol Hill Day and Due Diligence Symposium... Read More

ExchangeRight’s Recent Due Diligence Symposium a Success

ExchangeRight is thankful to announce that its recent Due Diligence Symposium was a success, with more than 50 due diligence professionals, investment officers, and other financial specialists meeting in Laguna Beach, California... Read More

ExchangeRight Confirms No Exposure to Any Failed Banks

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that it has no exposure to any failed banks... Read More

ExchangeRight Fully Subscribes $40.75-Million Value-Add Portfolio 2 DST

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced that investors have fully subscribed its $40.75-million Value-Add Portfolio 2 DST... Read More

ExchangeRight's Blue Vault Alts Summit 2023 Agenda

ExchangeRight Managing Partner Warren Thomas, Director of National Accounts Geoff Flahardy, and Senior Vice President Michele Drummond look forward to connecting with advisors and representatives March 6–8 at the Blue Vault Bowman Alts Summit... Read More

ExchangeRight Completes 10 Full-Cycle Events in 2022 with Annual Returns Ranging from 6.67% to 11.25%

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, announced it successfully met or exceeded investor cash flow targets across all offerings in 2022 while completing 10 successful full-cycle... Read More

ExchangeRight Fully Subscribes 25-Property, $71 Million Net-Leased Portfolio

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce that it has fully subscribed its Net-Leased Portfolio 58 DST, a $71,135,000 offering featuring... Read More

ExchangeRight Fully Subscribes Latest DST Designed For Recession Resilience

ExchangeRight, one of the nation's leading providers of diversified real estate DST and REIT investments, is pleased to announce that it has fully subscribed its $58.95 million Net-Leased Portfolio 57 DST, which features... Read More

Watch: “Investing in a Challenging Real Estate Market” Discussion with Warren Thomas

We are pleased to share a new video of a discussion between ExchangeRight Managing Partner Warren Thomas... Read More

ExchangeRight’s Net-Leased DST Achieves 151.80 to 157.63 Percent Total Returns Including Return of Capital

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has successfully brought its 31st offering full cycle out of a total of 83 offerings launched on behalf of investors... Read More

ExchangeRight DST Achieves 129.54 to 137.89 Percent Total Returns Including Return of Capital

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has brought its $69.6 million Net-Leased Portfolio 21 DST full-cycle on behalf of its investors by selling it to a REIT... Read More

ExchangeRight Fully Subscribes 33-Property, $132 Million Net-Leased Portfolio

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce it has fully subscribed its $132.30 million Net-Leased Portfolio 56 DST, which features... Read More

ExchangeRight Offering Achieves 152.96 to 158.71 Percent Total Returns Including Return of Capital

ExchangeRight has brought its $47.39 million Net-Leased Portfolio 9 DST full cycle on behalf of its investors by selling it to a REIT... Read More

ExchangeRight Offering Achieves 145.82 to 150.87 Percent Total Returns Including Return of Capital

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has brought its $46.84 million Net-Leased Portfolio 11 DST full cycle on behalf of its investors by selling it to a REIT... Read More

ExchangeRight Completes $219 Million DST Full Subscription

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce that it has fully subscribed its largest offering to date with Net-Leased Portfolio 55 DST, a $219.95 million offering... Read More

ExchangeRight Offering Achieves 132.28 to 147.89 Percent Total Returns Including Return of Capital

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has brought its $66.57 million Net-Leased Portfolio 19 DST full cycle on behalf of its investors by selling it to an acquiring REIT... Read More

ExchangeRight Announces $179 Million Portfolio Full Subscription

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, announced that Melissa Birdsall has joined the firm as senior vice president of the North Eastern region for its broker-dealer and RIA... Read More

Melissa Birdsall Joins ExchangeRight’s Broker-Dealer and RIA Relations Team

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, announced that Melissa Birdsall has joined the firm as senior vice president of the North Eastern region for its broker-dealer and RIA... Read More

ExchangeRight Completes $62 Million Full-Cycle Event

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the completion of its 26th successful full-cycle event through the sale of its $62.18 million Net-Leased Portfolio 18 DST to an... Read More

ExchangeRight Expands Broker-Dealer and RIA Relations Team with Michele Drummond, SVP

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce the expansion of its broker-dealer and RIA relations team with the addition of Michele Drummond as senior vice... Read More

ExchangeRight Fully Subscribes $176 Million Net-Leased Portfolio, Its Largest to Date

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced it has fully subscribed its largest 1031-eligible investment offering to date... Read More

ExchangeRight’s Beth Veloz Selected for IPA’s Rising Leaders Council

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, is pleased to announce that Beth Veloz, senior vice president of ExchangeRight’s BD/RIA relations team, has been recognized as a rising... Read More

ExchangeRight Announces Its 25th Full-Cycle Event

ExchangeRight, one of the nation’s leading providers of diversified real estate DST and REIT investments, has announced the completion of its 25th successful full-cycle event through the sale of its $68.40 million Net-Leased Portfolio 17 DST to... Read More

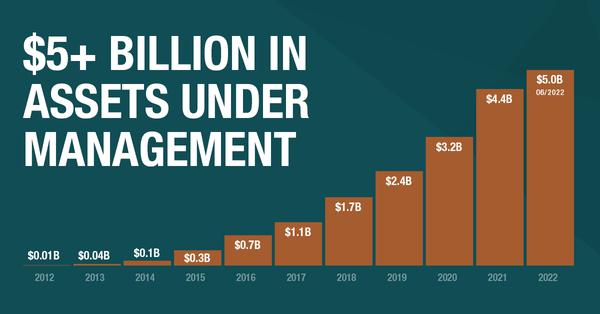

ExchangeRight Surpasses $5 Billion in Assets Under Management

ExchangeRight, one of the nation’s leaders in diversified real estate investment strategies, announced that the company and its affiliates have surpassed more than $5 billion in assets under management... Read More

ExchangeRight Launches Value-Add Platform with Latest DST Subscription

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, is pleased to announce the successful launch of a new value-add platform with the full subscription of its Value-Add Portfolio 1 DST... Read More

The Wall or the Cliff? ExchangeRight’s Macro Perspective

A Macroeconomic Update from ExchangeRight’s Joshua Ungerecht... Read More

ExchangeRight Fully Subscribes 26-Property, $134 Million Net-Leased Portfolio

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, has fully subscribed its $134 million Net-Leased Portfolio 52 offering, which features 449,424 square feet of retail, medical, banking and pharmacy... Read More

ExchangeRight Fully Subscribes $91 Million, 24-Property Net-Leased Portfolio

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, has fully subscribed its $91 million Net-Leased Portfolio 51 DST offering of 24 properties across 13 states... Read More

ExchangeRight Fully Subscribes $124 Million 30-Property Net-Leased Portfolio

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, has fully subscribed its $124 million Net-Leased Portfolio 50 offering, containing 30 net-leased properties covering 676,976 square feet across... Read More

ExchangeRight Completes Twenty-Fourth Full-Cycle Event With Sale of Net-Leased Portfolio

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, announced that it has completed its 24th full-cycle event with the $34 million sale of its Net-Leased Portfolio 6 DST to a net-leased REIT, providing... Read More

ExchangeRight’s Sister Company, Telos Capital, Executes Value-Add Sale with 19.50% Net Annual Internal Rate of Return for Investors

Telos Capital, sister company of ExchangeRight, has brought its TCF9 Milford, MA Multifamily, LLC offering full cycle. The investment was in a 304-unit garden-style multifamily property in suburban Boston... Read More

ExchangeRight Takes Twenty-Third Portfolio Full Cycle

ExchangeRight, one of the nation’s leaders in diversified real estate investments and strategies, announced that it has completed its 23rd full-cycle event with the sale of its Net-Leased Portfolio 16 DST... Read More

Join Warren Thomas Virtually at Blue Vault Alts Week for a Deep Dive Into Alternative Investments

ExchangeRight invites you to join Managing Partner Warren Thomas at The 2022 Blue Vault Bowman Alts Week, occurring virtually March 7-11, 2022... Read More

ExchangeRight Completes Twenty-Second Full-Cycle Event for its DST Platform

ExchangeRight has completed its twenty-second full-cycle event on behalf of investors with the successful $31.23 million sale of Net-Leased Portfolio 7 DST. ExchangeRight provided the investors in the portfolio with the option to perform... Read More

ExchangeRight Surpasses $64 Million in Lifetime Charitable Donations, Giving Over $23 Million in 2021

ExchangeRight is pleased to share that the company and its partners provided over $23 million in charitable donations in 2021, bringing its life-to-date charitable giving to over $64 million in support of charities that have demonstrated success... Read More

ExchangeRight Sets New Record with over $673 Million of Capital Entrusted in 2021

Investors entrusted over $673 million into ExchangeRight's net-leased and value-add DST, preferred equity, and REIT offerings in 2021, representing over 27% growth from 2020, the company’s best year on record... Read More

ExchangeRight Fully Subscribes a $126 Million Diversified Net-Leased Offering

ExchangeRight has fully subscribed its $126 million Net-Leased Portfolio 49 DST offering, which is designed to generate investor distributions from approximately 600,000 square feet of net-leased property... Read More

ExchangeRight’s Latest Full-Cycle Event Achieves 157-163% Returns for Investors Including Return of Capital

ExchangeRight brought its $23 million Net-Leased Portfolio 5 DST full cycle on behalf of its investors. In connection with the closing, ExchangeRight provided the investors in the portfolio with the option to perform another 1031 exchange, receive... Read More

ExchangeRight Exits the Multifamily Market

ExchangeRight has brought its sixth and final multifamily offering full cycle, generating total returns of 154.48% including return of capital to the DST and its investors... Read More

Watch: Warren Thomas Discuss Best Practices for REITs & Risk Reduction

ExchangeRight Managing Partner Warren Thomas recently joined Blue Vault’s Inside the V(ALT) video podcast series... Read More

ExchangeRight Takes Net-Leased Portfolio DST Full Cycle, Achieving Annualized Returns from 6.54% to 7.99%

ExchangeRight has brought another Net-Leased Portfolio DST full cycle in Q3 2021, generating annualized returns of 6.54% for investors who chose to cash out or complete a 1031 exchange with their proceeds. For investors who chose to complete... Read More

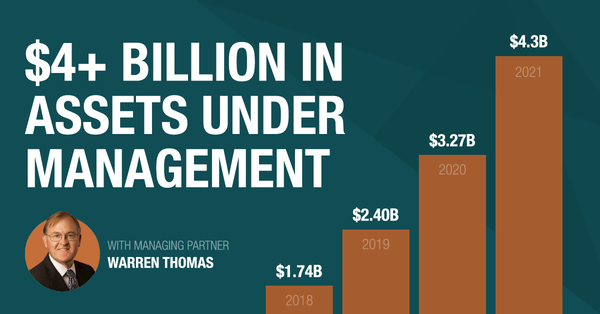

ExchangeRight Surpasses $4 Billion in Assets Under Management with All Portfolios Meeting or Exceeding Projections

ExchangeRight and its affiliates have surpassed $4 billion in assets under management with the full subscription of ExchangeRight’s 50th net-leased portfolio, maintaining 100% rent collection across all 975+ of its net-leased properties... Read More

ExchangeRight Affiliate Telos Capital Achieves Over 11% Investor Annual IRR with RV Resort Development

ExchangeRight's sister company Telos Capital, a private equity real estate investment company that focuses on value-add and development real estate investments across all asset classes and sectors, has brought its TCF2 Stella Mare investment full... Read More

IPA Honors David Fisher with Outstanding Service Award for His Advocacy Efforts

The Institute for Portfolio Alternatives (“IPA”) has honored David Fisher, a managing partner of ExchangeRight, with its Outstanding Service Award, highlighting his work as a staunch advocate for Section 1031, real estate investors... Read More

Net Lease Investors Fully Subscribe an ExchangeRight $86 Million Offering

ExchangeRight has fully subscribed its $86.38 million Net-Leased Portfolio 48 DST offering, which is designed to generate investor distributions from over 287,000 square feet of net-leased property... Read More

Watch: David Fisher Joins Blue Vault's Stacy Chitty to Report on Urgent Tax Policy Advocacy

ExchangeRight Managing Partner David Fisher has been on the front lines of ongoing lobbying and grassroots efforts to educate policymakers about the devastating impact of proposed restrictions in the original draft of the American Families Plan... Read More

ExchangeRight Affiliate Telos Capital Achieves 21.1% Investor IRR with Value-Add Industrial Portfolio

ExchangeRight's sister company Telos Capital, a private equity real estate investment company that focuses on value-add real estate investments across all asset classes and sectors, has brought its TCF12 Columbus Industrial, LLC investment... Read More

Investors Seeking Net Lease Stability Fully Subscribe ExchangeRight’s Latest DST Offering

ExchangeRight has fully subscribed its $58.85 million Net-Leased Portfolio 47 DST offering, which is designed to preserve investor capital, generate stable income, and provide access to ExchangeRight's aggregated exit strategy... Read More

How You Can Help Preserve the 1031

Your help is needed in the fight to preserve the 1031. Congress is deciding now whether to overhaul tax rules to severely limit the benefits of 1031 like-kind exchanges... Read More

ExchangeRight Acquires a Multi-Tenant Retail Center Near Milwaukee for $19.30 Million

PASADENA, Calif. - ExchangeRight is pleased to announce it has completed the acquisition of an $18.24 million multi-tenant shopping center anchored by Pick ‘n Save in Wauwatosa, Wisconsin. The property is anchored by a Pick 'n Save grocery store... Read More

Join Our Webinar for an Inside Perspective on the Campaign to Preserve the 1031

ExchangeRight invites you to attend Managing Partner and CPA David Fisher’s webinar presentation, "The Fight to Preserve the 1031 Exchange" followed by a live Q&A, on Monday, August 9 at 4:00 PM EDT... Read More

ExchangeRight Successfully Subscribes an $81 Million DST Offering

ExchangeRight has fully subscribed its $81.11 million Net-Leased Portfolio 46 DST offering... Read More

Help Us Preserve the 1031 Exchange

The 1031 exchange is under attack. The American Families Plan includes severe restrictions on the benefits that IRS Section 1031 provides to American investors in its present form. Not only would limiting Section 1031 fail to achieve... Read More

ExchangeRight Subscribes $68.15 Million DST Invested in 17 Properties Net-Leased to Essential Businesses

ExchangeRight, a vertically integrated real estate company that has met or exceeded investor cash flow targets on all of its offerings since inception, has fully subscribed its $68.15 million Net-Leased Portfolio 45 DST offering. Read More

ExchangeRight Fully Subscribes Another Net-Leased DST Offering

ExchangeRight has fully subscribed its all-equity $23.77 million Net-Leased Portfolio 44 DST offering... Read More

ExchangeRight Fully Subscribes $96.85 Million DST 100% Net-Leased to Essential Businesses

ExchangeRight has fully subscribed its $96.85 million Net-Leased Portfolio 43 DST offering leased exclusively to tenants operating in seven essential industries serving 16 markets across the nation. The offering’s properties are net-leased to... Read More

ExchangeRight Takes Two Net-Leased Portfolios Full Cycle, Achieving 129-168% Total Returns for Investors Including Return of Capital

ExchangeRight Takes Two Net-Leased Portfolios Full Cycle, Achieving 129-168% Total Returns for Investors Including Return of Capital Read More

NAPA Auto Parts’ Sole Member, Genuine Parts Company, Receives New BBB Credit Rating

Genuine Parts Company, the sole member of NAPA Auto Parts (“National Automotive Parts Association”), was recently assigned a BBB investment-grade rating from Standard & Poor’s after having been previously unrated by the organization... Read More

Tenants Highlight: Vaccine Distribution

A number of ExchangeRight tenants are on the front lines of the COVID-19 vaccine distribution, doing their part in the nation’s effort towards immunization. We are pleased to see our tenants continue to play a crucial role in communities across... Read More

ExchangeRight’s Texas Multifamily Portfolio Significantly Outperforms Year 3 Projections

ExchangeRight has announced that its El Paso Apartment Portfolio has outperformed its originally projected annualized cash flow distributions by 27.89% for its fiscal year 3, providing investors with... Read More

Tenant Highlight: Tractor Supply Receives BBB Credit Rating From Standard & Poor’s

We are pleased to announce that the percentage of our portfolio’s annualized base rents generated from investment-grade tenants has increased significantly in light of the recent rating of Tractor Supply’s credit of BBB (Standard & Poor’s) and... Read More

ExchangeRight Achieves 100% Rent Collections in 2020 for All of Its Net-Leased Offerings

ExchangeRight has collected 100% of 2020 rent totaling approximately $129 million in net rents across all $3+ billion of its net-leased assets under management... Read More

Watch: Why Is Vertically Integrated Asset Management Essential?

We are pleased to share the seventeenth installment of our video series in which ExchangeRight’s managing partners provide investing insights on a range of topics including how to select recession-resilient assets and tenants, lease structures... Read More

ExchangeRight Continues to Sell its Multifamily Investments with Latest Full-Cycle Event

ExchangeRight has brought its North Austin Apartment Portfolio DST offering full cycle, generating total returns of over 128.9% including return of capital to the DST and its investors... Read More

Tenant Highlight: Dollar Tree Receives Upgraded Credit Rating

We are pleased to announce that one of our major net-leased tenants, Dollar Tree, has recently received an upgrade of its investment-grade credit rating from BBB- to BBB. Standard & Poor’s credits the upgrade to Dollar Tree’s resilient performance... Read More

ExchangeRight Fully Subscribes $77 Million Diversified Portfolio Featuring Walmart Neighborhood Market

ExchangeRight has fully subscribed its $77 million Net-Leased Portfolio 42 DST offering leased exclusively to tenants operating essential businesses... Read More

ExchangeRight Reports Record-Breaking Year in 2020

ExchangeRight is pleased to report that 2020 was a record-breaking year for the company despite the economic turbulence caused by COVID-19 and the government-imposed shutdowns across the country... Read More

ExchangeRight Fully Subscribes $121.4 Million Net-Leased DST Focused on Investment-Grade Essential Businesses

ExchangeRight has fully subscribed its $121.4 million Net-Leased Portfolio 41 DST offering leased to 11 national creditworthy tenants serving essential needs, including... Read More

ExchangeRight Lifetime Charitable Donations Surpass $41 Million, Contributing Over $16 Million in 2020

ExchangeRight has announced that the company has had the opportunity to donate over $16.9 million in 2020 and over $41.2 million life-to-date to charities committed to... Read More

Watch: Why Does ExchangeRight Focus on Capital Preservation?

We are pleased to share the sixteenth installment of our video series in which ExchangeRight’s managing partners provide investing insights on a range of topics including how to select recession-resilient assets and tenants, lease structures and ... Read More

Watch: What Should Investors Consider Before Investing in a REIT?

We are pleased to share the fifteenth installment of our video series in which ExchangeRight’s managing partners provide investing insights on a range of topics including how to select recession-resilient assets and tenants, lease structures and ... Read More

ExchangeRight Fully Subscribes $99.72 Million DST Portfolio Net-Leased Exclusively to Essential Businesses

ExchangeRight has fully subscribed its $99.72 million Net-Leased Portfolio 40 DST offering leased exclusively to... Read More

ExchangeRight Surpasses $3 Billion in Assets Under Management and Hits 100 Consecutive Months of Uninterrupted Distributions Meeting or Exceeding Cash Flow Targets

ExchangeRight has surpassed $3 billion in assets under management in the same month that it has reached 100 consecutive months of providing uninterrupted investor distributions at rates meeting or exceeding projected cash flow targets... Read More

Watch: Alignment of Interests

We are pleased to share the fourteenth installment of our video series in which ExchangeRight’s managing partners provide investing insights on a range of topics including how to select recession-resilient assets... Read More

ExchangeRight Takes Another DST Full Cycle, Achieving 130% to 141%+ Total Returns for Investors Including Return of Capital

ExchangeRight has brought its Net-Leased Portfolio 13 DST portfolio full cycle, generating total returns of over 130% including return of capital for investors who chose to cash out or complete a 1031 exchange... Read More

ExchangeRight Fully Subscribes $97.43 Million DST Offering Net-Leased To Essential Businesses

ExchangeRight has fully subscribed its $97.43 million Net-Leased Portfolio 39 DST offering designed to generate stable cash flows to investors, starting at 6.21% annualized... Read More

Watch: 1031 Exit Options

We are pleased to share the thirteenth installment of our new video series, about how ExchangeRight creates flexible and strategic exits for investors in its 1031 platform... Read More

ExchangeRight’s Broker-Dealer & RIA Relations Team Welcomes David Flamm

ExchangeRight is pleased to announce the appointment of David Flamm as vice president of its BD and RIA relations team... Read More

Real Assets Adviser - What the Pandemic Has Wrought for Real Estate: Five Property Types and Their Prospects

ExchangeRight managing partner Warren Thomas recently contributed to Real Asset Adviser's October issue to discuss the economic collapse and its impact on the real estate industry. Warren's feature goes into detail about the resilience of... Read More

Watch: Exit Strategy Structure

We are pleased to share the twelfth installment of our new video series, about how ExchangeRight structures its long-term exit strategy to be competitive in the public markets and to protect investors in timing our aggregated exit strategy. Read More

ExchangeRight Achieves 169% to 181%+ Total Returns for Investors Including Return of Capital with Another Full Cycle DST Offering

ExchangeRight has brought another net-leased portfolio DST full cycle, generating total returns of over 169% including return of capital for investors who chose to cash out or complete a 1031 exchange... Read More

Blue Vault and ExchangeRight Discuss Pandemic Performance

ExchangeRight partner Joshua Ungerecht was recently interviewed by Blue Vault to discuss 1031 and REIT investment strategies for protecting capital and building wealth even through times of economic crisis... Read More

ExchangeRight Fully Subscribes $54.52 Million Offering Diversified Across Pandemic-Resilient Assets

ExchangeRight has fully subscribed its $54.52 million Net-Leased Portfolio 38 DST offering... Read More

ExchangeRight August and September Rent Collections Update

ExchangeRight is pleased to announce that it has collected 100% of August and September rent from its net lease tenants on behalf of its investors... Read More

ExchangeRight Fully Subscribes $39.08 Million Offering Focused on Creditworthy Essential Businesses

ExchangeRight has fully subscribed its $39.08 million Net-Leased Portfolio 37 DST, an offering designed to generate stable income and protect investor capital with its diversified portfolio of net-leased assets backed by national corporations that... Read More

ExchangeRight Fully Subscribes $44.5 Million Offering Focused Exclusively on Essential Businesses

ExchangeRight has fully subscribed its $44.5 million Net-Leased Portfolio 36 DST offering... Read More

Watch: What Is Our Exit Strategy?

We are pleased to share the eleventh installment of our new video series, about ExchangeRight’s long-term aggregation and exit strategy... Read More

ExchangeRight Fully Subscribes Another Offering Focused on Properties Leased to Essential Businesses

ExchangeRight has fully subscribed its Net-Leased Portfolio 35 DST, an offering that is designed to generate stable income and protect investor capital with its diversified portfolio of net-leased assets backed by national corporations that... Read More

ExchangeRight Affiliate Telos Capital Takes Offering Full Cycle with 38%/Year Investor Returns

ExchangeRight's sister company, Telos Capital, a private equity company that focuses on discounted and opportunistic value-add real estate investments across all asset classes and sectors, has brought its TCF18 Norwood, MA Biotech Facility, LLC... Read More

Sustained Growth Through the Downturn: View Our Latest Corporate Overview

We are pleased to present the newest version of our Corporate Overview, representing our latest performance figures and track record information for the highly diversified portfolios and recession-resilient assets that we steward on behalf of... Read More

ExchangeRight Fully Subscribes Another All-Cash Portfolio of Properties Leased to Essential Businesses

ExchangeRight has fully subscribed Net-Leased Portfolio 34 DST, its latest all-equity offering. The offering is designed to generate stable income and protect capital by focusing exclusively on investment-grade quality tenants operating essential... Read More

Watch: Lease Renewals

We are pleased to share the tenth installment of our new video series, about the metrics that ExchangeRight considers in determining whether potential tenants will renew their leases in the future, to design offerings that provide stable income... Read More

Watch: Debt Service Coverage Ratio

We are pleased to share the ninth installment of our new video series, about the importance of strong debt service coverage ratios in ExchangeRight’s offerings, designed as another measure to protect investors against risk. Read More

Watch: Debt Laddering

We are pleased to share the eighth installment of our new video series, about the importance of debt laddering in constructing ExchangeRight’s diversified portfolios. Read More

Our Essential Tenants' Latest Response to the COVID-19 Pandemic

Our tenants are launching charitable initiatives for underserved communities and developing new products to meet the needs of the public... Read More

Watch: Common Investor Needs

We are pleased to share the seventh installment of our new video series, about the common investor needs that guide the construction of ExchangeRight's offerings... Read More

ExchangeRight Q2 Rent Collections Update

ExchangeRight is pleased to announce that it has collected 100% of April, May, and June rent from all of its tenants on behalf of investors and has consistently delivered uninterrupted cash flow distributions to investors for all of its portfolios... Read More

Our Essential Tenants Continue to Outperform Through the Economic Crisis

Our investment-grade and national credit tenants operating essential businesses in the necessity-based retail and healthcare industries continue to experience strong financial results even in the face of the economic turmoil caused by the COVID-19... Read More

Watch: Recession-Resilience Case Study: Dollar General

We are pleased to share the sixth installment of our new video series on one tenant, Dollar General, to highlight what about ExchangeRight’s tenants makes them recession-resilient... Read More

Watch: Amazon Resilience

We are pleased to share the fifth installment of our new video series on how ExchangeRight develops Amazon-resilient offerings... Read More

ExchangeRight Fully Subscribes All Cash Offering Designed for Recession Resilience

ExchangeRight has fully subscribed its $33.64 million Net-Leased Portfolio 33 DST offering, an all equity offering... Read More

Watch: Long-Term Net Leases

We are pleased to share the fourth installment of our new video series on the importance of long-term net leases in ExchangeRight’s offerings... Read More

Los Angeles Business Journal Interviews Managing Partner Joshua Ungerecht

Read what ExchangeRight managing partner Joshua Ungerecht has to say about recession, investment-grade tenants, net-leased assets, and more... Read More

The Real Estate CPA Podcast Interviews Managing Partner Warren Thomas

Listen to managing partner Warren Thomas's new interview with The Real Estate CPA Podcast where he discusses 721 exchanges, 1031 exchanges, DSTs, REITs, exit strategies, and more... Read More

Watch: Investment-Grade Tenants

We are pleased to share the third installment of our new video series on the importance of investment-grade tenants in ExchangeRight’s offerings... Read More

Our Tenants' Latest Response to the COVID-19 Pandemic

Our tenants continue to rise to the occasion to provide their essential goods and services during the COVID-19 pandemic and to do their part in helping America fight the virus... Read More

ExchangeRight Announces Performance Update in Response to Recent Market Events

ExchangeRight continues to meet its investors’ needs and expectations despite the economic downturn caused by the COVID-19 pandemic... Read More

Watch: How We Select Recession-Resilient Real Estate

We are pleased to share the second installment of our new video series on how we select recession-resilient real estate... Read More

Watch: Recession-Resilient Real Estate

We are pleased to share the first installment of our new video series on recession-resilient real estate... Read More

Blue Vault Interviews ExchangeRight Managing Partners Warren Thomas and Joshua Ungerecht in Advance of Blue Vault Bowman Alts Week 2020

ExchangeRight managing partners Warren Thomas and Joshua Ungerecht were recently interviewed by Blue Vault about our recession-resilient investment strategy... Read More

ExchangeRight Fully Subscribes $119 Million Net-Leased DST Offering in Two Months

ExchangeRight has fully subscribed its $119 million Net-Leased Portfolio 32 DST offering only two months after its February launch... Read More

Our Tenants' Latest Response to COVID-19 Crisis and Demand

Over the past few weeks, we have shared encouraging and uplifting news about ExchangeRight’s tenants and their incredible response to the COVID-19 pandemic... Read More

Blue Vault and ExchangeRight Discuss COVID-19's Impact

ExchangeRight partners Warren Thomas and Joshua Ungerecht were recently interviewed by Blue Vault to discuss our recession-resilient investment strategy and the ongoing impact of the COVID-19 pandemic on the alternative investment industry. Read More

How Our Tenants Are Responding to the COVID-19 Crisis

When we founded ExchangeRight, we decided to focus on recession-resilient tenants with investment-grade credit in the necessity-based retail and healthcare industries. We could not have chosen a better asset class to protect the capital that... Read More

ExchangeRight Fully Subscribes Recession-Resilient $119 Million Net-Leased DST Offering

ExchangeRight has fully subscribed its $119 million Net-Leased Portfolio 31 DST offering. The portfolio is designed to generate stable income and protect capital by focusing on investment-grade quality tenants in the necessity-based retail and ... Read More

ExchangeRight Fully Subscribes $113.34 Million Net-Leased DST Offering

ExchangeRight has fully subscribed its $113.34 million Net-Leased Portfolio 30 DST offering. The nationally diversified portfolio is invested in properties with long-term net leases to investment-grade quality tenants operating successfully in the... Read More

ExchangeRight Fully Subscribes $115.1 Million Net-Leased DST Offering

ExchangeRight, the nation’s second largest sponsor of securitized 1031-exchangeable real estate investments, has fully subscribed its $115.1 million Net-Leased Portfolio 29 DST offering. The portfolio is invested in nationally diversified ... Read More

ExchangeRight Fully Subscribes $99.95 Million Net-Leased DST Offering

ExchangeRight has fully subscribed its $99.95 million Net-Leased Portfolio 26 DST offering, following a record-breaking year of sales in 2019, representing 48% year-over-year growth. The portfolio is invested in nationally diversified properties ... Read More

ExchangeRight Lifetime Charitable Donations Surpasses $23 Million

ExchangeRight, the nation’s second largest sponsor of securitized 1031-exchangeable real estate investments, has announced that as of the end of 2019 the company has raised over $23 million in life-to-date donations to charities... Read More

ExchangeRight Takes DST Offering Full Cycle with Total Returns from 125% to Over 135% Including Return of Capital

ExchangeRight, the nation’s second largest sponsor of securitized 1031-exchangeable real estate investments, has brought Net-Leased Portfolio 12 DST full cycle on behalf of its investors. The offering invested in net-leased, necessity retail ... Read More

ExchangeRight Brings 378-unit Multifamily DST Program Full Cycle with 6.82% Annualized Investor Returns

ExchangeRight, one of the nation’s largest sponsors of securitized 1031-exchangeable real estate investments, has brought another multifamily DST full cycle, bringing the company’s total multifamily sales for 2019 up to $94.6 million ... Read More

ExchangeRight Fully Subscribes $117.1 Million Net-Leased DST Offering

ExchangeRight, one of the nation’s largest sponsors of securitized 1031-exchangeable real estate investments, has fully subscribed its $117.1 million Net-Leased Portfolio 28 DST offering. The offering launched in July 2019 and is invested in ... Read More

ExchangeRight Fully Subscribes $94 Million DST Offering During Record-Breaking Q3

ExchangeRight, one of the nation’s largest sponsors of securitized 1031-exchangeable real estate investments, has fully subscribed its $94 million Net-Leased Portfolio 27 DST offering. The offering launched in May 2019 and is invested in ... Read More

ExchangeRight Takes Another Net-Leased Portfolio Full Cycle with Total Returns Ranging from 136% to over 146% Including Return of Capital

ExchangeRight has brought Net-Leased Portfolio 8 DST full cycle on behalf of investors. The offering invested in net-leased, necessity retail properties backed by investment-grade tenants that have been acquired as part of ExchangeRight’s... Read More

ExchangeRight Takes Two Net-Leased Portfolios Full Cycle with Total Returns Ranging from 145% to 176% Including Return of Capital

ExchangeRight, the nation’s second largest sponsor of securitized 1031-exchangeable real estate investments, has brought two net-leased portfolios full cycle. The offerings were invested in necessity retail net-leased properties backed by ... Read More

ExchangeRight Brings Three Multifamily DSTs Full Cycle, with Annual Investor Returns ranging from 7.27% to 10.81%.

ExchangeRight, the nation’s second largest sponsor of securitized 1031-exchangeable real estate investments, has recently brought three of its DST programs full cycle. The DSTs had each invested in value-added Class B multifamily properties, which... Read More

ExchangeRight Adds Internal Wholesaler Larry Baron to Its Sales Team

ExchangeRight, one of the nation’s largest sponsors of privately held 1031-exchangeable real estate, has announced the appointment of Larry Baron as Vice President over the Rocky Mountain/Western-Central region in the expansion of its ... Read More

ExchangeRight Adds Internal Wholesaler Scott Peterman to Its Sales Team

ExchangeRight, one of the nation’s largest sponsors of privately held 1031-exchangeable real estate, has announced the appointment Scott Peterman as vice president over the Great Lakes and Eastern regions in the expansion of its broker-dealer... Read More

ExchangeRight and Its Affiliates Surpass $2 Billion in Assets Under Management

ExchangeRight, the third largest sponsor of privately held 1031-exchangeable real estate investments in the United States by volume, announced today that it surpassed $2 billion of assets under management together with its affiliates as of ... Read More

Media Relations Contact:

Lindsey Thompson

Senior Media Relations Officer

(626) 773-3448

press@exchangeright.com