When considering net-leased real estate, it is important to secure the right type of tenant, a sufficient lease term, and the right lease structure. The terms of your lease spell out your and your tenant’s rights and have a material impact on the value of your asset over the long run. Please note that this article is not comprehensive and only covers a portion of the aspects one needs to be aware of to properly analyze a lease. However, double- and triple-net leases tend to have a number of standard terms and clauses to look for which are discussed in the sections below.

When considering net-leased real estate, it is important to secure the right type of tenant, a sufficient lease term, and the right lease structure. The terms of your lease spell out your and your tenant’s rights and have a material impact on the value of your asset over the long run. Please note that this article is not comprehensive and only covers a portion of the aspects one needs to be aware of to properly analyze a lease. However, double- and triple-net leases tend to have a number of standard terms and clauses to look for which are discussed in the sections below.

Obligations: In any type of lease structure, it is important to understand the obligations of the tenant vs. the landlord. The obligations for both parties are essential to the proper administration and valid enforcement of a lease. For instance, if the landlord is required and fails to carry a certain level of insurance, the tenant may have the right to cease making rent payments or terminate the lease altogether. If the maintenance of the common areas of a property (shared by several tenants) is the landlord’s obligation, certain leases may provide liability against the landlord if a failure to maintain common areas causes injury to a customer or employee or damage to a tenant’s equipment or property.

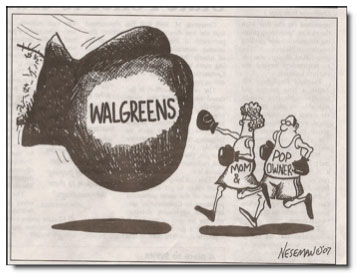

Knowing the tenant obligations is one thing—enforcing them is another! In many cases, tenants may ignore their obligations or send notice to the landlord stating that a particular issue is the responsibility of the landlord. Unfortunately, an increasing number of net-leased real estate owners are “mom and pop” investors who do not have adequate legal understanding or representation to stand up to these tenants, so many tenants get away with putting a portion of their financial obligations back onto the landlord. It takes a good knowledge of the lease and a carefully and strongly worded letter and eventual threat of default to get some tenants to be responsive.

Knowing the tenant obligations is one thing—enforcing them is another! In many cases, tenants may ignore their obligations or send notice to the landlord stating that a particular issue is the responsibility of the landlord. Unfortunately, an increasing number of net-leased real estate owners are “mom and pop” investors who do not have adequate legal understanding or representation to stand up to these tenants, so many tenants get away with putting a portion of their financial obligations back onto the landlord. It takes a good knowledge of the lease and a carefully and strongly worded letter and eventual threat of default to get some tenants to be responsive.

Many tenant obligations require the landlord to provide prior notice or proof of financial expenditures before the tenant is responsible to comply with their duty. In some cases, there are expirations attached to these landlord notice provisions that allow the tenant to legally side-step their obligations due to a failure of the landlord to timely make notice.

Each lease is unique and requires the landlord to fully understand the responsibilities of each party involved in the lease. It is crucial for landlords to also understand how to enforce the tenant’s compliance with their obligations and provide the proper notice to ensure that they do not miss out on key financial provisions in the lease. Understanding landlord vs. tenant obligations also reveals what the likely real net return would be when certain landlord operating and maintenance responsibilities (typical of double-net leases) are taken into account.

Liabilities: With any lease, it is important to ensure that your tenant’s space and business are their responsibility. Typically, if you are the landlord, you will bear some structural risk, should something happen on your property that causes someone harm. However, do not allow operational risk of the tenant’s business to fall back on you. Your lease should include clauses that hold you harmless from any operational risk related to your tenant’s business. General tenant risks may include use of any physically or environmentally hazardous materials, work-related injuries, business related lawsuits, or damage caused to a tenant’s furniture or fixtures (the decorations, shelf space, inventory, signage, etc. a tenant places in and around their space) in the course of their operations. This is not a comprehensive list of liabilities, but we can furnish you with a more complete list that is located in most primary lease templates.

When it comes to the outside of the building, and depending on the lease structure, it is highly likely that you will be responsible as the landlord for certain liabilities. For example, if a prospective customer of your tenant slips and falls on a sidewalk in disrepair outside the building that is located on your property, and if you happened to have been responsible for the maintenance of that sidewalk, you will likely be named in a suit and could be held liable. This underlines again the importance of understanding the obligations section of the lease as well as the need for liability insurance even when you are buying net-leased real estate. Many people think that they will be shielded by the tenant, but this typically only applies in absolute triple-net leases or in leases that are more of a ground lease structure than a typical net-leased structure. Even in those cases, you may still be named in a suit and it still makes sense to be covered by liability insurance (whether by the tenant’s insurance if you are also names or your own separate policy).

Contractual Lease Escalations…aka “Rent Bumps”: Unless you buy a long-term triple net property with a decent discount to market price or that is coming up to the end of its lease term without renewal options, you generally want to look for a lease that includes contractually obligated increases to the lease payment throughout the lease term and in the lease options. Typically, double-net leases provided more favorable rent escalations than triple-net leases. While renewal options often have built in lease escalations, rent increases in the primary lease term are becoming more and more rare in this low interest rate environment. These contractual increases in rent are called “rent bumps” and can provide a partial hedge against inflation over the longer-run.

Over the long run, the dollar tends to lose its value and buying power. It is helpful if your rent payments are increasing so that the value of your income and your asset rise with inflation. Think of the difference between what $1 buys today vs. what it would have bought 50 years ago, 20 years ago, or even 10 years ago! Now, think of a rent payment fixed at $30,000 for the past 20 years. Not only would the purchasing power be diminished--the asset would have had a very difficult time appreciating without an increasing income stream. If the lease payment increased by 1% annually for the past 20 years, it currently would be $36,605, a 22% increase over the original lease payment. The increased lease payment would translate into higher prices for the resale of the asset. We typically encourage our clients to target an average of at least 1–2% rent bumps per year, depending on the quality of the tenant. Again, this is getting much harder to do in this environment, but it should still be a goal.

Renewal Options: Renewal options give the tenant the right but not the obligation to renew their lease for specified terms and rates upon the expiration of their initial, fixed term. Properly structured renewal options give value to both the tenant and the landlord, as they provide a tenant surety of what their future rent costs will be without directly obligating them. They provide the landlord prior notice of a tenant’s intentions of renewal before the lease term is up (generally, six months’ notice is required by the tenant). This arrangement allows both parties to prepare for their longer-term obligations and needs. If the tenant renews, the landlord and tenant know exactly what their income and costs will be, respectively. If the tenant does not renew, the process can give the landlord enough time to try to find a replacement when the tenant’s initial term expires.

Not all renewal options are created equal. A common example of the type of renewal option to avoid is the option structure typically associated with Walgreens’ leases. Walgreens’ leases can look initially attractive, with 15-25 years or more on the initial term. However, they then will attach five to ten five-year additional renewal options, adding 25-50 years to the initial term WITHOUT lease bumps. Regardless of the strength of the tenant, this means that the landlord could be stuck with 50-75 years of the same lease payment. This option is not only a poor hedge against inflation, but it greatly reduces your ability to resell the asset to a buyer for any profit in the distant future because the buyer will not want to be locked into the long-term nature of the fixed lease payments.

Not all renewal options are created equal. A common example of the type of renewal option to avoid is the option structure typically associated with Walgreens’ leases. Walgreens’ leases can look initially attractive, with 15-25 years or more on the initial term. However, they then will attach five to ten five-year additional renewal options, adding 25-50 years to the initial term WITHOUT lease bumps. Regardless of the strength of the tenant, this means that the landlord could be stuck with 50-75 years of the same lease payment. This option is not only a poor hedge against inflation, but it greatly reduces your ability to resell the asset to a buyer for any profit in the distant future because the buyer will not want to be locked into the long-term nature of the fixed lease payments.

We encourage our clients to seek renewal options that total 5-15 years. In some circumstances, we have advised our clients to accept longer renewal options if the renewal options are favorable to the landlord, with sufficient increases in the rent obligations for each renewal period. Rent bumps must be sufficient over the lease term AND the option renewal periods to protect the investor from inflation and provide him a better chance of appreciation throughout the property’s hold period.

There are always exceptions to the rule, the primary one being a good enough initial entry cap rate on purchase that is high enough to justify a profitable five-ten year hold period even if the remaining option periods are flat. The general rule, however, is that you want to get renewal options with healthy increases if you can. Just like with the reduction of rent escalations in the primary term, many tenants have realized that they can get away with the “Walgreen’s” model of renewal options and we are starting to see less favorable renewal option terms.

Notice: Leases that require renewal or termination notices give landlords a cushion of time to know whether a tenant is renewing or prepare for a tenant’s departure if they do not renew. Notice requirements oblige the tenant to make their intentions known typically 6-18 months prior to the end of their lease. The ability of a tenant to take advantage of options is often tied to notice requirements so that the tenant is motivated to make a decision ahead of time. Some notice requirements include penalties if a tenant does not give sufficient notice to the landlord according to the lease agreement.

As referenced earlier, notice provisions go both way in leases. Many notice provisions are directed at the landlord and require the landlord to provide reports or proof of payments before tenant obligations go into effect. It is important for you to be aware of both the landlord and the tenant notice provisions in your lease.

Early Termination Options: Some leases include early termination options. These clauses allow a tenant to give notice within a specified timeframe and legally terminate a lease before their initial, fixed term is complete. Most early termination options will require a tenant’s prior notice 6-18 months before the termination goes into effect and require an agreed upon lump sum payment by the tenant in order to effect the termination. The lump sum payment helps offset the landlord’s costs in finding a replacement tenant. It is smaller than a tenant’s entire lease obligation, should they have remained in the lease for the full term. We encourage clients to avoid leases with early termination options--especially given these current market conditions. Most tenants who have been lucky enough to have their fixed lease terms expire in this current economy have taken advantage of soft rental markets to cut their costs and negotiate significantly lower lease payments. We believe that it is important for our clients to bridge this uncertain leasing environment with long-term leases that are fixed and free of any early termination options.

Early Termination Options: Some leases include early termination options. These clauses allow a tenant to give notice within a specified timeframe and legally terminate a lease before their initial, fixed term is complete. Most early termination options will require a tenant’s prior notice 6-18 months before the termination goes into effect and require an agreed upon lump sum payment by the tenant in order to effect the termination. The lump sum payment helps offset the landlord’s costs in finding a replacement tenant. It is smaller than a tenant’s entire lease obligation, should they have remained in the lease for the full term. We encourage clients to avoid leases with early termination options--especially given these current market conditions. Most tenants who have been lucky enough to have their fixed lease terms expire in this current economy have taken advantage of soft rental markets to cut their costs and negotiate significantly lower lease payments. We believe that it is important for our clients to bridge this uncertain leasing environment with long-term leases that are fixed and free of any early termination options.

Co-Tenancy Clauses: Co-tenancy and other types of conditional “out” clauses can provide a back door for your tenant to get out of their lease. A co-tenancy clause allows a tenant to “go dark” (i.e., cease operations at that location) or terminate their lease if another major tenant located adjacent to their space “goes dark” or files for bankruptcy. For instance, a CVS located within a grocery-anchored shopping center may reserve the right to halt rent payments, shut down operations at your location, or even terminate their lease with you, should the grocery store that anchors that shopping center stop operations or go out of business. Another type of co-tenancy clause allows a tenant to be freed from the obligations of their lease if a tenant in the same or similar type of business is allowed to take space in the same shopping center or directly adjacent to the original tenant. In other words, Pizza Hut would attempt to limit the ability for another pizza company, like Domino’s, to move in right next door. These clauses give tenants protection and competitive advantages in their specific locations. The tenants can enact their right to terminate their leases if those clauses are triggered. While these types of clauses are common in normal leases, it is important to be aware of and analyze the probability of such clauses being enforced.

Tenant Buyout/Sublease: A landlord must control the terms of use of the space they are leasing. Even though a tenant may have a property under the NNN lease format, they typically are not allowed to make material changes to the way they use their space without the prior permission of the landlord. This allows the landlord to control, on a general level, the types of businesses and uses of their property. If a discount clothing company bought out Rite Aid, they would not be able to simply turn all of their Rite Aid locations into clothing warehouses. They would have to maintain the original business on the leased premises under which the lease was written. A properly written lease will require that the tenant receive prior written permission from the landlord to materially change their business operations in their leased space.

Tenant Buyout/Sublease: A landlord must control the terms of use of the space they are leasing. Even though a tenant may have a property under the NNN lease format, they typically are not allowed to make material changes to the way they use their space without the prior permission of the landlord. This allows the landlord to control, on a general level, the types of businesses and uses of their property. If a discount clothing company bought out Rite Aid, they would not be able to simply turn all of their Rite Aid locations into clothing warehouses. They would have to maintain the original business on the leased premises under which the lease was written. A properly written lease will require that the tenant receive prior written permission from the landlord to materially change their business operations in their leased space.

Allow Us to Do the Heavy Lifting for You

ExchangeRight offers 1031 exchange replacement property investments for accredited investors participating in 1031 tax deferred exchanges as well as accredited investors seeking to invest in net-leased property. ExchangeRight currently manages over $250 Million of real estate comprised of 113 net leased retail properties and one multifamily community diversified across 26 states. We take on the due diligence, acquisition, and asset management responsibilities so that investors in our offerings can enjoy entirely passive income while. We consistently deliver diversified portfolios of long-term, net-leased assets backed by investment grade corporations in the necessity retail space. We have also launched a multifamily platform with Threshold Capital to bring value-added multifamily offerings to 1031 exchange and cash investors. Threshold Capital has acquired and managed over 9,800 apartment units with an aggregate market value of over $540 Million. Please visit www.exchangeright.com or call (855) 31-RIGHT to learn more.